How Do I Withdraw Money From Discover Bank

Advertiser Disclosure This commodity/mail contains references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services.

Discover® Depository financial institution is an online banking concern that offers fantabulous rates for savers with low fees. In this review, we'll encompass why you lot might want an online savings account, Discover'southward products, rates, and fees.

Interested in opening a savings business relationship at Discover® Bank? Read this article first. You may know Discover® for their credit cards, merely they have an impressive suite of cyberbanking products, from online savings and checking accounts to retirement accounts. Go on reading for a full clarification of how to open up an account and our review of using Discover® Bank.

Why Open a Discover® Bank Online Savings Account

If y'all're thinking almost setting upward an online savings account, it'south probably considering you lot've heard online banks offer better interest rates than traditional brick-and-mortar. And you're right. You lot're also probably looking at saving up for a worthy goal–like edifice up your emergency fund, getting enough greenbacks for a downward payment on a house, or ownership a new car. For goals like these where yous want your money to still work for you (i.e., to make money from involvement!), you need to be able to admission information technology in a pinch, and you lot don't want to risk losing coin considering of a sudden downturn in the market, online savings accounts are slap-up.

Merely earlier nosotros get to how to ready an account, let's go over some nuts. Deposits at Discover® Banking company are insured by the FDIC and the banking company has earned a five-star "Safe & Sound" rating from Bankrate. FDIC insurance solitary, regardless of the five-star rating, ensures that regardless of the solvency of the bank, I will be able to withdraw my total deposit when needed.

One of the reasons I like Observe® Savings Accounts is considering they are free–there'south no monthly fee and no minimum balance required. Plus, yous're not required to set up an ongoing directly deposit. The but fees you would have to pay with this account is if you wired money – there'southward a $thirty service charge for outgoing wire fees. Since I'd planned to use this account to salve and non send wire transfers, the fee for something I didn't programme to use wasn't nearly as big of a deal as the fact information technology didn't have fees for everything else (but patently you'll need to appraise your personal situation).

Pros:

- High APY, fifty-fifty with smaller balances (many banks require y'all to have a significant rest earlier getting the higher APY rates)

- No fees

- Great mobile app (necessary for an online depository financial institution)

- FDIC insured

Cons:

- Limited branches (though how much of a con this is really depends on whether you lot similar going to a physical bank and waiting in line – I don't so this isn't a big upshot for me).

- No debit card for like shooting fish in a barrel cash withdrawals

How to Open up a Discover® Depository financial institution Online Savings Account

Since Discover® is an online bank, you'll open your business relationship online. Information technology's a quick and easy procedure and y'all won't need to collect a bunch of documents to begin.

I decided to open a savings account. Merely Discover® Bank also offers:

- FDIC-insured Certificates of Deposit (CDs) accounts with iii month to 120 month terms

- Coin Market place Accounts

- IRA Savings Accounts (both Roth IRA and Traditional IRA options)

- IRA Certificate of Eolith (CDs) with 3 month to 120 calendar month terms

- Checking Accounts (more on why it might be a practiced idea to combine your Observe® online savings account with their checking account later on)

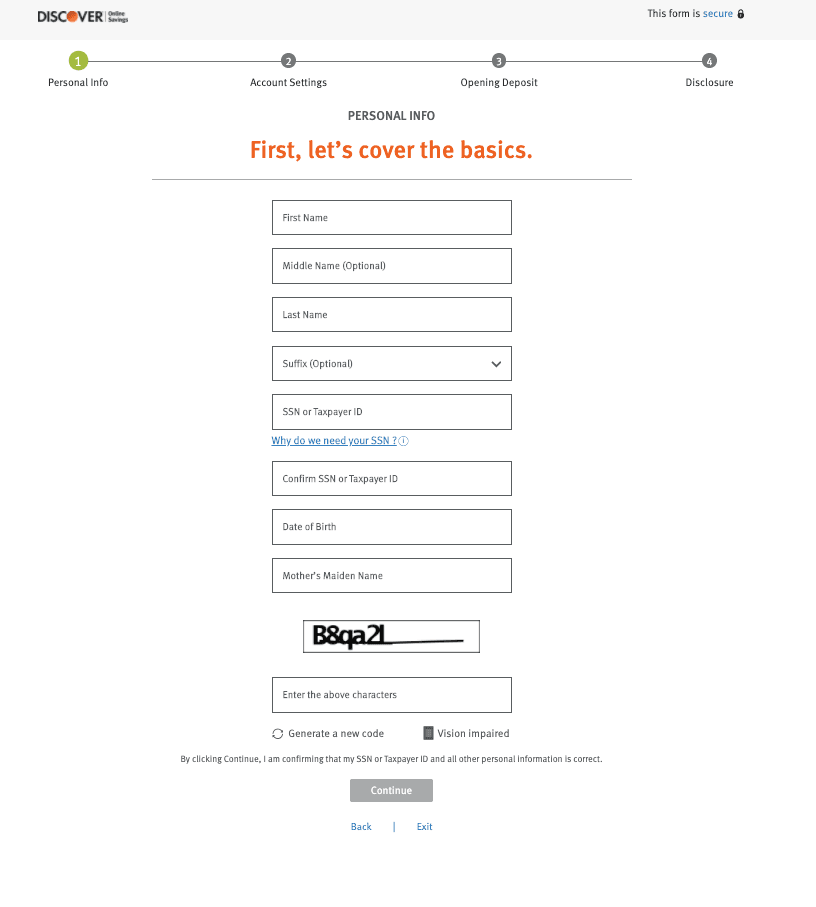

Pace 1. Basic Details

On their website, I clicked on Savings Account (though if you aren't certain what kind of account is best for your needs, in that location'south a handy quiz on their site). I started past giving some basic details–merely every bit I would with any banking company–including my name, my address (inside the United States), my date of nativity, and my Social Security number.

They also ask for data on my employment condition, my yearly income, and my land of citizenship.

Adjacent, they asked if I wanted to add a joint owner to the account. This is great if you want to salvage with your partner or anyone else. If you aren't sure or don't have all their relevant details, you can always do this later.

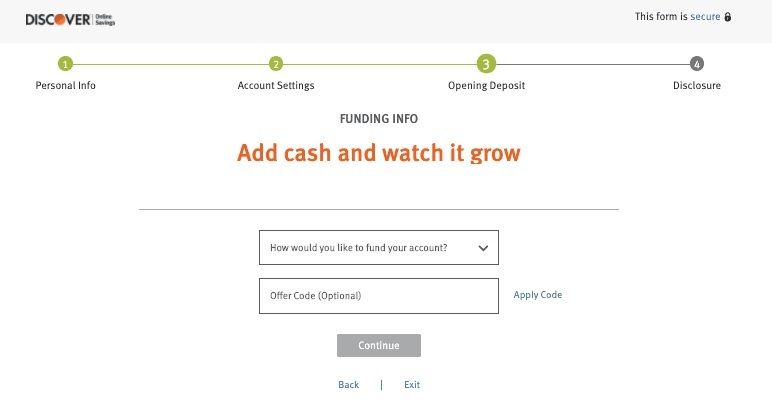

Pace 2. Fund the Account

The second step of the awarding is all about funding the account. I decided to link the account to my Upper-case letter One 360 checking account with an initial deposit of $2,500, which I funded electronically.

Discover® Bank does not crave a minimum for the initial eolith, which is fantastic as you can ready it up with any you have and commit yourself to saving more.

If you prefer to fund your business relationship via a wire or bank check, Discover® Bank offers these options likewise. In society to requite your consent to Discover® Bank to perform an ACH transfer, y'all will need to provide an electronic signature.

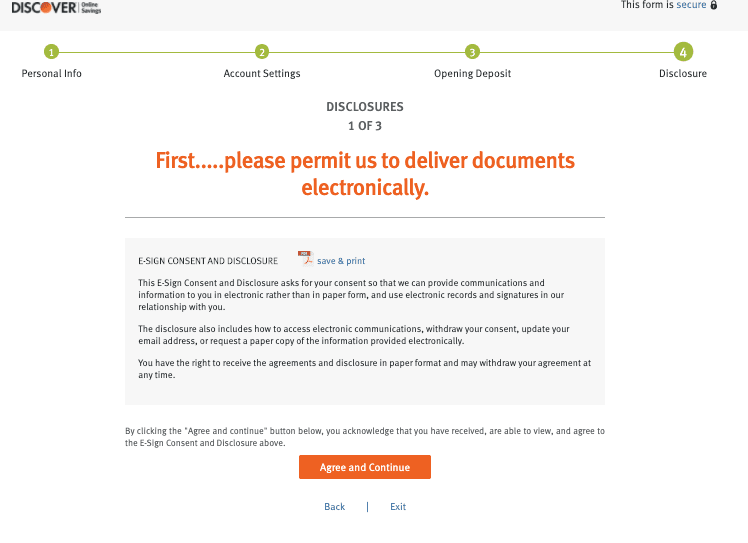

Stride iii. E-Sign

In the final step, I verified the information I provided, electronically signed the tax certification, and agreed to electronic communications.

Banks are required to keep account possessor signatures on file and Discover® Depository financial institution handled this electronically as well.

Step four. Ready Security

Once the bank processed my application, I was asked a number of security questions based on the information in my credit written report. Many websites apply this type of authentication. For case, yous may be asked to select the town where you lived previously from a list of choices.

Important Note: On the confirmation page, you will see your full account number. Relieve this information past press the page or jotting the number downwards at present because y'all will need your business relationship number later in lodge to activate your online access. The bank will not send information technology to you through electronic mail, and it will take upwardly to ten days to receive your welcome package in the mail.

After passing the security and identity bank check, I received an email confirming the creation of my new account, including a partially-hidden account number. Those who decide to fund their new account via check will receive the bank'south depository addresses for regular U.S. mail or overnight mail service in this e-mail.

Interestingly (and one of the only downsides I've institute with my Notice® account) is that wire transfers are processed through Mellon Banking company rather than being sent direct to Discover® Bank. This ways it's a bit more of a hassle to set up wire transfers, but it's not a large enough deal that I'd switch accounts (especially since the APY on this account is competitive).

Banking Bargain : Earn 1.85% APY on an FDIC-insured money market account at CIT Banking concern.

Using the Detect® Bank Online Savings Account

A day afterwards receiving the first email, I got a second email that confirmed my account was funded. That was faster than I'd expected, considering I started the process over a weekend. The email included a link to Notice's website where I registered my new business relationship online. After verifying this email was legitimate and not a phishing attempt (which you should always do to stay safe), I followed the instructions.

Did you lot save your account number, like I warned you well-nigh? If not, you lot will need to call the Bank's customer service. You need the account number, your Social Security number, your engagement of birth, and your mother's maiden name in guild to activate online account access.

After selecting a user ID, a password, and security questions, I was able to view my business relationship online. I was surprised to meet Discover® had already posted interest to my business relationship. Y'all tin can see how much I received for one solar day in the screen shot included here.

You can utilize the Discover® Banking company website to set up recurring transfers through their "Automated Saving Plan" or initiate a one-time transfer from a linked business relationship. If you want to link a new account, you volition exist asked to enter the banking information and required to verify small trial deposit amounts. Unfortunately, the account I used for the initial deposit is not automatically considered a linked account. I must go through the procedure of adding the aforementioned account to the list.

Find® Banking company Savings and CD Rates

Observe® Bank offers iii terrific deposit accounts for every customer. And their rates are also some of the best you lot tin notice online.

- Online Savings Business relationship – 0.lxx% APY

- Loftier Yield CD's – 1.50% APY (for a 12 month CD) – ii.75% APY (for a v year CD)

- Money Market – 0.60% APY (for balances less than $100,000) – 0.65% APY for balances greater

My Feel with Discover® Bank Online Savings Account

I've loved my Discover® savings account – I like checking the involvement I make every month on my emergency fund. The app is easy to use. If I get an unexpected check in the post, I can easily use the app to deposit it directly into my account.

I've taken advantage of Discover's checking account to make the whole thing work a bit improve for me. You won't get a debit card to use at ATMs with your savings account, then when you want to access your money, you'll demand to move it into another account or ship a check. (This isn't unusual – afterward all, you're using this business relationship to salvage, non pay your monthly bills). This hasn't been an issue for me since I have a checking account with Detect® that gives me costless ATM withdrawals across the country. If I need to take out money from my savings account, I can use the app to quickly transfer money from savings to checking and then withdraw it at the nearest ATM. I don't see a real drawback to setting upwards a checking account since it'due south free.

Alternatively, Discover'due south money marketplace account (which has lower interest rates, but even so higher than what you'd notice at a typical banking concern) has limit-free ATM withdrawals.

If not having a debit card with your savings account is a dealbreaker for you, then you'll want to look at some alternatives.

But what if you don't want to set up either a savings business relationship or money market business relationship (both come with use of the extensive ATM network) – how practise you lot go your coin out? Y'all can withdraw funds with:

- A wire transfer (call back these will incur a $xxx service fee, so I'd recommend against using this option)

- Official bank check

- Online transfers to external bank accounts

- Transfer to other Discover accounts (I've plant this to exist the easiest and fastest selection – your money moves immediately, so you can do this on your smartphone's app while walking up to the ATM machine and take the cash ready to withdraw from another account in seconds).

Bottom Line

The procedure of opening a Discover® Depository financial institution online savings account was smooth and quick. When I called Discover's customer service to get my account number, the representative was helpful and friendly. My phone call, placed on a Sunday afternoon, was answered without any concord time. Find® Bank's features are bones, but it meets the needs of savers with the bonus of a highly competitive interest rate. I plan on taking a closer look at the banking concern's high-yield CDs in the about futurity. Later on some fourth dimension using it, I haven't had any problems with my Discover® Bank. To open up an account visit Observe® Bank.

Discover® Bank

| Routing (ABA) number | 031100649 |

| Established | August 30, 1911 |

| FDIC document | 5649 |

| Location | 12 Read's Style, New Castle, Delaware |

| Straight Connect | Not supported |

| Web Connect | Supported |

| Mint/Yodlee | Supported |

Source: https://www.consumerismcommentary.com/discover-bank-online-savings-account-review/

Posted by: denniefout1942.blogspot.com

0 Response to "How Do I Withdraw Money From Discover Bank"

Post a Comment